Act CVIII of 2023 on the Rules of Corporate Social Responsibility to Encourage Sustainable Financing and Corporate Social Responsibility with Emphasis on Environmental Consciousness, and Social and Welfare Matters (“ESG Act”) was adopted by the Hungarian Parliament in December 2023, and the companies that are subject to it are required to carry out sustainability due diligence reviews and to prepare related statements and reports after 1 January 2024.

The ESG Act can be divided into two distinct parts. Firstly, the Act imposes sustainability obligations on companies in preparation for compliance with the Corporate Sustainability Due Diligence Directive (CSDDD), which has yet to be adopted. Additionally, the ESG Act serves to ensure compliance with the CSRD [Corporate Sustainability Reporting Directive, or Directive (EU) 2022/2464 of the European Parliament and of the Council] through the modification of other legislation. Chapter 26 of the ESG Act has modified Act C of 2000 on Accounting (“Accounting Act”), which now includes provisions regarding sustainability reports and certain detailed rules; and it has also modified Act LXXV of 2007 on the Chamber of Hungarian Auditors, the Activities of Auditors, and on the Public Oversight of Auditors (“Auditors Act”), which now includes certain other complementary rules.

It should be noted that an ESG statement within the meaning of the ESG Act and the CSDDD is not the same as a sustainability report within the meaning of the CSRD.

Although there are certain overlaps between an ESG statement and a sustainability report due to their impact on sustainability, a sustainability report must be prepared in accordance with the rules pertaining to financial statements, while ESG statements involve a due diligence obligation that is more akin to compliance.

In this article we will identify the categories of companies that are subject to the ESG Act, describe what deadlines these companies will have to meet, and give an overview of the differences between an ESG statement and a sustainability report.

I. Obligations under the ESG Act

1. Personal scope [Section 1(1)]

The ESG Act applies to companies that have their registered office in Hungary and satisfy a complex set of conditions and definitions.

| Large undertakings that qualify as public-interest entities | Large undertakings | Small or medium-sized undertakings that qualify as a public-interest entities |

| that exceeded any two of the following three limits on the accounting reference date of the financial year that preceded the reported year: | that exceeded any two of the following three limits on the accounting reference date of the financial year that preceded the reported year:

|

The ESG Act does not set any other conditions with regard to companies that meet this definition. |

|

|

1.1. Businesses that qualify public-interest entities [Section 7.20]

According to the definition of the ESG Act, a company qualifies as a public-interest entity if it meets the definition in Section 2.19 of the Auditors Act.

On the basis of the relevant definition of the Auditors Act, a company is therefore a public-interest entity if a) its transferable securities have been accepted for trade on a regulated market in any of the Member States of the European Economic Area, or b) it is company that is not subject to point a) but is classed as a public interest entity by a statute.

1.2. Large undertakings [Section 7.26]

Under the ESG Act, a company qualifies as a large undertaking if it exceeded any two of the following three limits on the accounting reference date of the financial year that preceded the financial year in which the information is reported:

a) balance sheet total of EUR 25 million,

b) annual net sales revenue of EUR 50 million,

c) average number of employees of 250.

1.3. Small undertakings [Section 7.17]

For the purposes of the ESG Act, a company qualifies as a small undertaking if it did not exceed at least two of the following three limits on the accounting reference date of the financial year that preceded the financial year in which the information is reported:

a) balance sheet total of EUR 4 million;

b) annual net sales revenue of EUR 8 million,

c) average number of employees of 50.

1.4. Medium undertakings [Section 7.19]

Under the ESG Act, a company qualifies as a medium undertaking if it does not qualify as a micro undertaking, small undertaking or large undertaking.

1.5. Micro undertakings [Section 7.25]

Under the ESG Act, a company qualifies as a micro undertaking if it did not exceed at least two of the following three limits on the accounting reference date of a financial year:

a) balance sheet total of EUR 350 000,

b) annual net sales revenue of EUR 700 000,

c) average number of employees of 10.

Additionally, certain entities that do not belong to any of the above categories may also be subject to the ESG Act if they agree to report ESG data voluntarily or on the basis of a contract, or if they are mandated to do so by a statute.

Companies that must submit an ESG statement will also have to make an annual declaration about their own operation and the activities of their supply chain

2. Deadlines [Section 54]

The provisions regarding obligations pertaining to sustainability due diligence reviews will have to be applied for the first time with regard to

a) the 2024 financial year by large undertakings that qualify as public-interest entities, with the first ESG statement to be published in 2025;

b) the 2025 financial year by large undertakings, with the first ESG statement to be published in 2026;

c) the 2026 financial year by small and medium-sized undertakings that qualify as public-interest entities, with the first ESG to be statement published in 2027.

Large companies that qualify as public-interest entities and other large companies must comply with their sustainability due diligence obligations for the first time by uploading an ESG statement to an ESG platform. For the time being, this will not be followed by certification but by a provisional audit. The information reported in the ESG statement and the outcome of the provisional audit will not be made public.

3. Obligations under the ESG Act

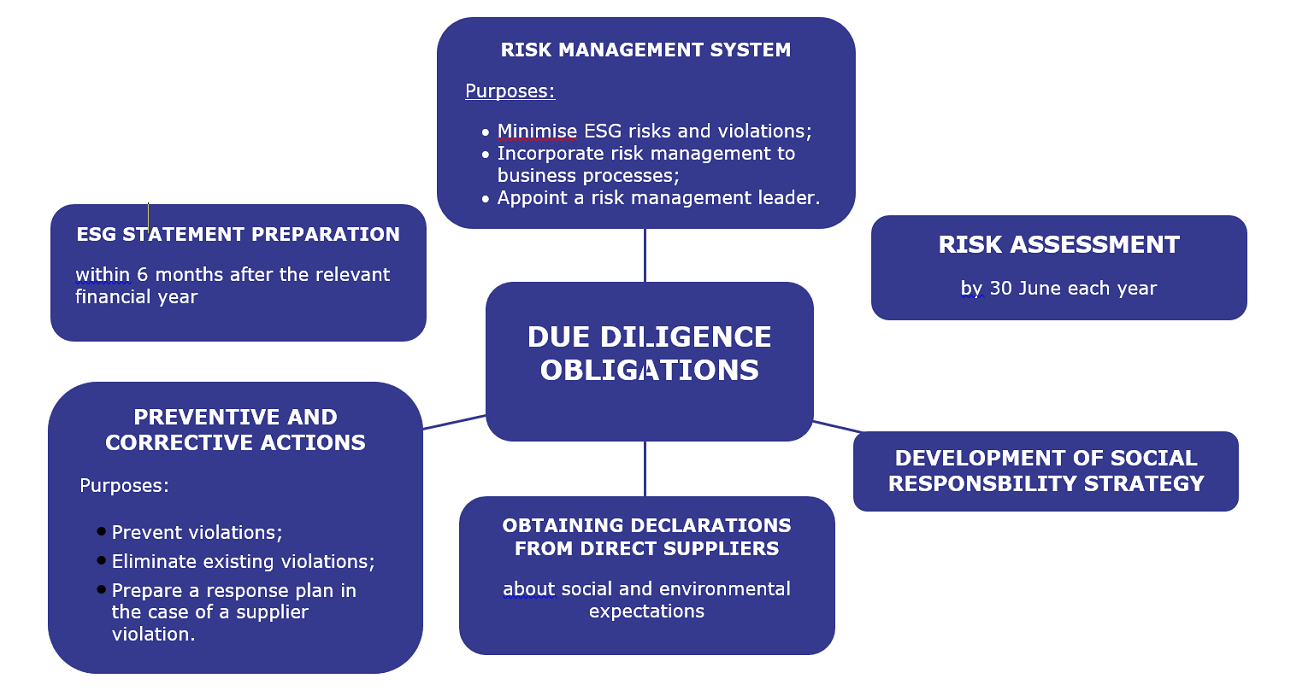

Under the ESG Act, companies will be required to disclose their sustainability risks and opportunities, and to publish the impact of their operation on the environment and on people. The following diagram illustrates some of the obligations associated with sustainability due diligence:

4. ESG statements: rules and required content

Under the ESG Act, companies have to prepare an annual ESG statement to demonstrate that they have complied with their obligation to carry out a sustainability due diligence review. Once an ESG statement is completed, it must be audited by an ESG auditor and then published. ESG statements must be prepared in an electronic format, and in Hungarian. The failure to prepare an ESG statement may result in the imposition of a fine (probably from 2026).

An ESG statement has to include a description of the impact of the company’s operations on sustainability and social matters, the impact of such matters on the company’s development and performance, the due diligence process itself, the ESG risks identified by the company, any violations of human rights and environmental laws, the actions taken in order to prevent, mitigate or remediate any adverse impact on sustainability, and the groups of people who are affected by corporate social responsibility issues.

II. Sustainability report

As mentioned above, the Accounting Act was also modified with the introduction of the ESG Act. As a result, the relevant companies are now required to issue what is known as a sustainability report. Sustainability reports are different form ESG reports.

1. Contents of a sustainability report [Accounting Act, Sections 95/E(3) through (15)]

A sustainability report must be prepared as a separate and clearly distinguishable part of a company’s business report, describe the impact of the company’s operation on sustainability matters, and include information relevant to understanding how sustainability matters affect the company’s development, performance and position.

The sustainability report has to provide a brief description of the company’s business model and strategy, including its resilience in relation to environmental, social and governance risks; its opportunities with regard to sustainability matters; its corporate plans regarding transition to a sustainable economy; how it identifies people affected by sustainability issues; the implementation of its sustainability strategies; and its sustainability objectives in view of the relevant deadlines (e.g. with regard to greenhouse gas emission reduction targets between 2030 and 2050). The report also has to address the competencies and roles of management bodies in sustainability matters; the company’s ESG policies; ESG incentives; the sustainability due diligence process; actual and potential adverse impacts connected with the company’s activities and its value chain; key sustainability risks and the related risk management arrangements.

If reasonable and justified, otherwise mandatory information does not have to be included in the report if its disclosure would violate the company’s business interests or if it is information that originates from a third party (e.g. a parent company having its registered office in a third country) but has not been provided to the company. However, the existence of such information must be mentioned in the report.

The fact that a sustainability report complies with the regulations is confirmed by an assurance opinion that is prepared by an auditor with sustainability certification. An assurance opinion is an opinion that is issued with regard to a sustainability report or consolidated sustainability report, on the basis of a limited assurance engagement, by an auditor that is a member of the chamber of auditors and has a sustainability certification.

The sustainability report is included in the business report and must be published electronically along with the annual financial statement.

2. Personal scope [Accounting Act, Sections 95/E (1) through (2)]

A sustainability report will have to be prepared by every company that is required to prepare an annual financial statement in Hungary, including the affiliates and branch offices of companies that are incorporated under the laws of an EU Member State or a third country.

Under the Accounting Act, the above obligations apply to a companies that

a) exceeded any two of the following three limits on the accounting reference date in two consecutive financial years that preceded the reported year:

- balance sheet total of HUF 10 billion,

- annual net sales revenue of HUF 20 billion,

- average number of employees of 250, or

b) do not qualify as a micro-enterprise and their transferable securities have been accepted for trade on a regulated market in any of the member states of the European Economic Area.

A consolidated sustainability report will have to be prepared by a parent company that is required to prepare a consolidated annual financial statement and satisfies the conditions pertaining to Hungarian companies.

3. Exemption [Accounting Act, Section 95]

An affiliate may be exempted from the above obligation if it (and its affiliates, if any) is (are) included in the consolidated sustainability report of its parent company. If a company’s parent company prepares a consolidated sustainability report, it can be exempted from the reporting obligation if its business report and the parent company’s consolidated sustainability report meets the statutory requirements.

However, the exemption does not apply to companies whose transferable securities have been accepted for trade on a regulated market in any of the member states of the European Economic Area.

Companies that would not be required to submit a sustainability report due to their size but are listed on a regulated market, small and non-complex institutions, captive insurance companies and captive reinsurance companies are allowed under the Act to prepare their sustainability report with information limited to the description of the following:

- business model and strategy;

- policies related to sustainability matters;

- key actual or potential adverse impacts of their operation on sustainability matters, and the actions taken to identify, monitor, prevent, mitigate, remediate or remedy such impacts;

- key risks associated with stainability matters such risks are managed;

- key indicators relevant to the disclosure of the above.

4. Deadlines [Accounting Act, Sections 177(96)-(106)]

The new rules will take effect in a staggered manner, i.e. the reporting obligations will start at different times for different classes of companies.

Large companies that qualify as public-interest entities, and parent companies that prepare consolidated accounts and qualify as public-interest entities will have to prepare and publish their sustainability report with regard to the 2024 financial year for the first time, while other large companies will have to do so with regard to the 2025 financial year.

III. Regulatory control

The ESG Act authorises the President of Regulated Activities Oversight Authority (Szabályozott Tevékenységek Felügyeleti Hatósága or SZTFH) to issue the rules pertaining to the minimum requirements, contents, formalities and publication of ESG statements. The President of the SZTFH will issue these rules after consultation with the National ESG Council, a body that will be established by the government minister responsible for the development of the economy.

Starting from 2024, the SZTFH is responsible for performing regulatory audits of the relevant companies, for supervisory activities through registration, accreditation and regulation in line with the ESG Act, the operation of the electronic platforms specified in the ESG Act, and for certain other activities listed in the ESG Act.

Authors: András Fenyőházi, Evelin Varga és Anna Nánási